One of the issues that really started to stand out to me as my income grew was taxes. What I learned was that taking taxes into account is almost as important as what your actual returns are. That’s why the second part of the Next-Level Income strategy is how to KEEP more of your money. While still in college I attended a course by a former IRS agent who outlined how the U.S. government wants you to invest your money and grow your wealth. That’s why there are so many benefits for real estate and business owners. The IRS code is the “Rule Book” for how to earn and invest.

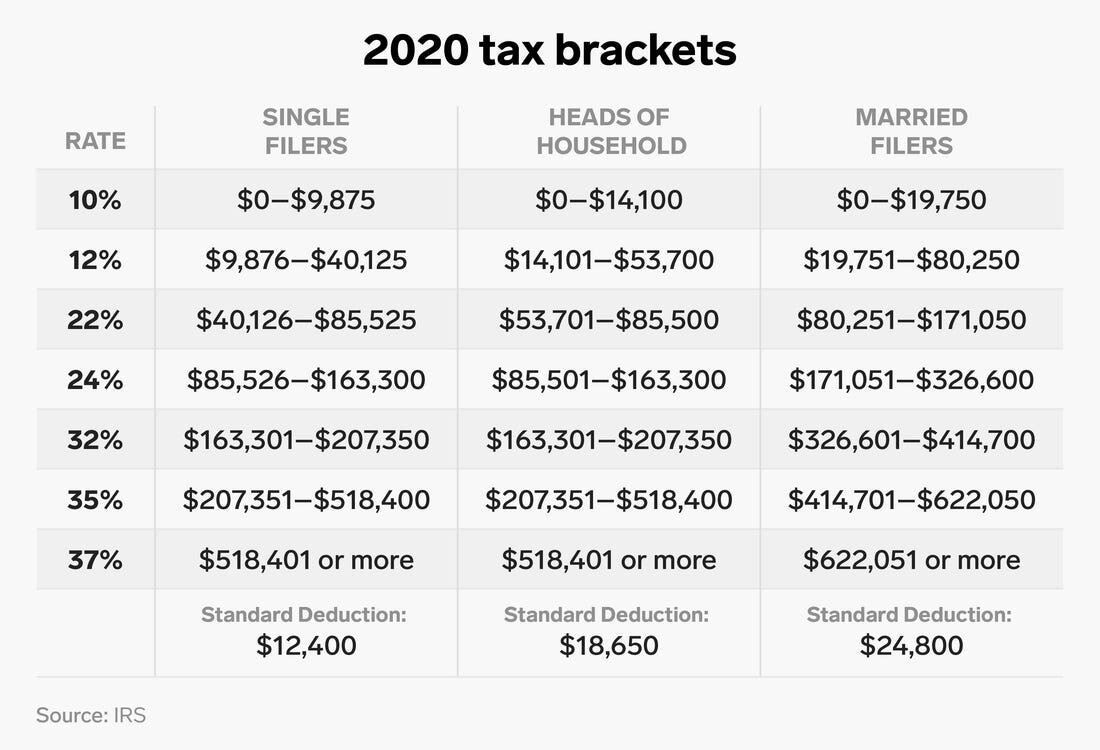

When I was in my early and mid-twenties (before I was married) my tax rate was in the 10%-15% range. I was making good money (around six-figures) and I was getting all of the benefits of depreciation from my single-family rental portfolio. Everything changed the year I got married! Now don’t get me wrong, I would do it all over again, no question. However when it comes to taxes in this country, there really is a marriage penalty; the year my wife and I got married my tax rate DOUBLED from around 10% to over 20%! We made a bit more money and I lost a bunch of right offs. Ouch! Here it is in all it’s glory:

Per IRS Publication 925 Passive Activity and At-Risk Rules, page 4:

Phaseout rule. The maximum special allowance of $25,000 ($12,500 for married individuals filing separate returns and living apart at all times during the year) is reduced by 50% of the amount of your modified adjusted gross income that is more than $100,000 ($50,000 if you are married filing separately). If your modified adjusted gross income is $150,000 or more ($75,000 or more if you are married filing separately), you generally can’t use the special allowance. This is because the special allowance is reduced to $0 since the modified adjusted gross income is over the $100,000 amount.

If you’re an Accredited Investor, then you probably aren’t getting all of the tax benefits that real estate has to offer. If you make more than $326,601 as a married couple in 2020, your marginal tax rate is going to look something like this:

Federal Tax: 32%

State/Local: 7% (median for the U.S.)

Total = 39%

Chances are you’re going to be paying FICA (Social Security, Medicare, etc.) in addition to other taxes. For simplicity, let’s use a marginal tax rate of 40%. Your actual rate is likely slightly higher or lower.

Let’s say your target after-tax rate of return is 12%, what do you have to earn before taxes? At a 40% marginal rate, you need to

be earning 20% or greater. Now that IS possible in the world of real estate. However, in my experience, rates like this have come from riskier or more active investments like vacation rentals, non-performing notes, development, etc.

If you are regularly investing in real estate deals and are selling and paying taxes every 5 years or so, it can significantly erode your overall returns. I detail an example of how this looks over 20 years in Chapter 9 of my book. It shows how over 20 years an initial investment of $100,000 compounding at 12% would grow to over $1M, while if you had to pay taxes it would cut your total returns by 50%! (You can get a free copy of my book here.)

If you are a high-income individual and are accredited, how can you get the best of both worlds? The 1031 exchange is an option that can save you hundreds of thousands or even millions of dollars over your lifetime. How does it work? You work with an intermediary when you sell one property and roll the gain into the next investment. Instead of cashing out, you reinvest your proceeds into a “like-kind” property. This allows your investment to continue to grow tax-deferred and there’s no limit on how many times you can do a 1031. I’ve personally used this strategy when selling a property with a significant gain. We employ the same strategy (when appropriate) when we are buying and selling our multifamily properties.

Multifamily properties, when structured properly, can preserve a lot of the tax benefits of owning real estate, and can actually accelerate the benefits, which I’ll write about in an upcoming podcast and article detailing what is called Cost Segregation. If you’d like to learn how I used the Next-Level Income strategy to build a portfolio of passive income investments, go to our website to get a free copy of my book and learn how to get access to cash flow investments.

Subscribe to The Next-Level Income Show