During my M.B.A. as I explored different industries that would be strong in the future, I came across demographic data that showed how Baby Boomers and ultimately their children, the Millennials would affect real estate and the healthcare space. It’s the reason that I decided to go into the medical device arena as well as move to Asheville, NC to benefit from migration trends toward the Southeast and smaller, exurban cities. As an engineer, I’ve always been data driven.

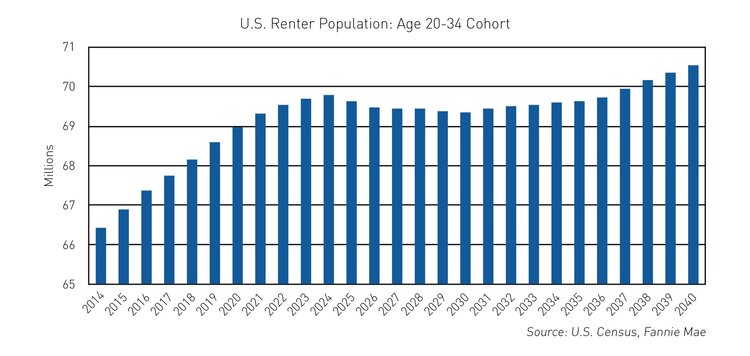

In 2012, as I reviewed my portfolio and analyzed the past 15 years I began to look forward again. The chart below illustrates why I chose to move into multifamily real estate (apartments) in 2013 and why the majority of my net worth and portfolio is invested here:

One thing you’ll notice is that the trend begins to slow over the next 5 years. It doesn’t reverse, and now Baby Boomers are the largest growing demographic of renters!

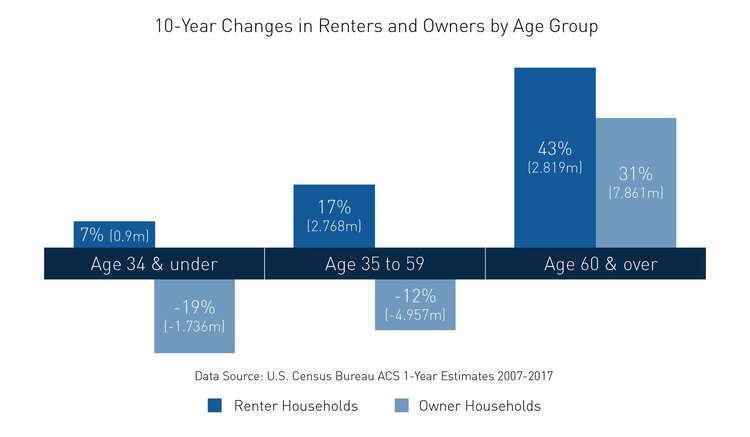

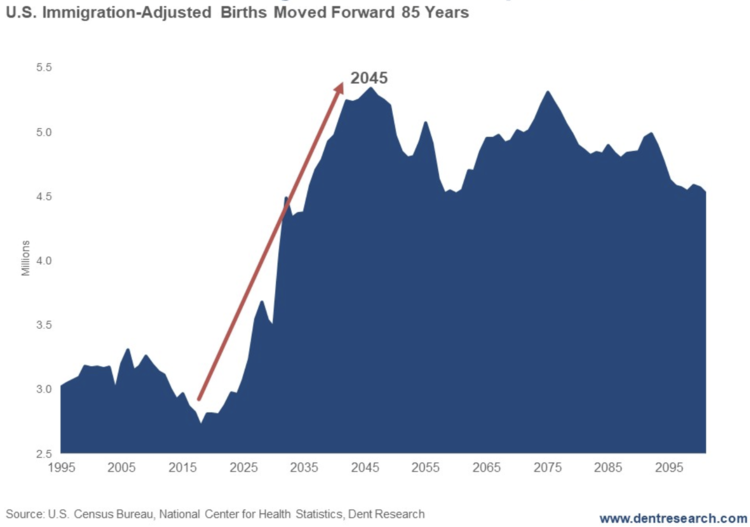

However, we are now on the verge of a virtual “Silver Tsunami of Seniors” (look at the chart below!). Earlier this year I began to look at shifting demographic and social trends. Every day 10,000 people turn 65! As these individuals enter their 80s they will need different housing and assistance.

So, as an investor, how do you take advantage of these trends? As the Boomers continue to rent, apartments remain a solid choice. Another area that I’m focused on learning about is Assisted Living. There are a few areas where you can look to invest: Nursing Homes, in-home Senior Care and also what’s called Residential Assisted Living. Check out our podcast with Loe Hornbuckle to learn more about how the “Silver Tsunami” is affecting real estate. You can also get a FREE copy of my book at our website to learn why multifamily residential is my preferred investment to take advantage of these demographic trends.

Subscribe to The Next-Level Income Show