In Chapter 5 of my book (get your free book and audiobook here), I cover the different types of options when investing in real estate.

What Is A REIT?

A REIT (Real Estate Investment Trust) is essentially a real-estate-flavored mutual fund. Investing in REITs is the easiest way to get exposure to real estate, since they have low or no minimum investment levels.

A REIT is a specific tax structure created in 1960 and has very specific guidelines under IRS code. They must invest at least 75% of the total assets in real estate, cash, or U.S. Treasuries and then pay 90% or more of its taxable income in the form of shareholder dividends each year.

While REITs allow for diversification of a portfolio, they are also highly correlated to the stock market due to their liquidity, and the fact that when investors sell stocks, they often sell REIT shares along with them.

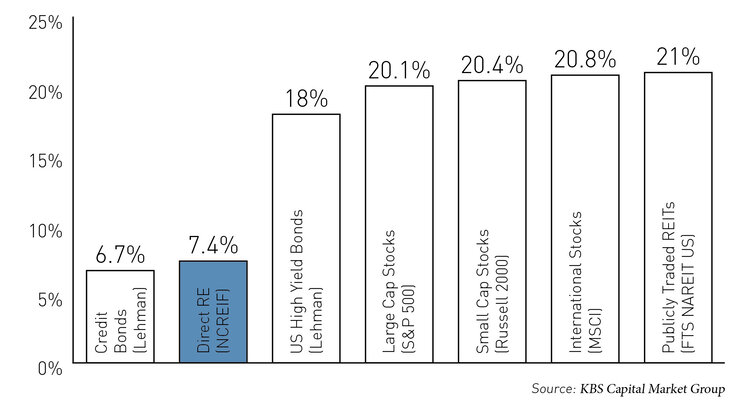

The following chart shows the risk or volatility levels across stocks and REITS, on the far right at 21%, compared to Directly Owned Real Estate (NCREIF), second from left in blue at 7.4%:

Notice how volatile REITs are?

What Is The Benefit Of A REIT?

As mentioned above, REITs offer low minimum investments and are liquid. In addition, they are treated favorably from a tax perspective. Typically a corporation has to pay taxes first, distribute dividends, and then shareholders have to pay taxes. This is why you hear about “double taxation.” The IRS rules for REITs means that there are no taxes at the corporate level; only the shareholders pay taxes. Investors in a REIT will receive a 1099-DIV at the end of the year for tax purposes.

Advantages Of A Private Placement

A private offering, or PPM, is a direct investment into a real estate asset. They are typically structured as a Limited Partnership or LLC. These are typically used to purchase one asset, but may buy multiple assets or even be a fund. For investors, this means that you know the asset that you are investing in versus waiting and seeing what the fund managers decide to buy. As an investor you typically receive distributions from this structure and your tax form will usually be a K-1.

For many investors there is an advantage with this structure as losses can be passed through directly to investors, which is not available in a REIT and 1099. This can oftentimes be a significant difference for investors who wish to decrease their tax burden.

These “losses” come from depreciation, a type of “phantom expense.”

What Is A Phantom Expense?

Phantom expenses decrease your taxable income but don’t decrease your cash flow. Our favorite is depreciation. The reason is that deprecation can offset much (if not all) of the income from a property, thus enhancing after-tax returns. The tax code allows you to use depreciation, or cost recovery, to write off the value of the physical structures that make up your property (but not the land it’s on) over time.

The time period of depreciation for residential buildings such as apartments is currently set at 27.5 years. So if you have a $12 million property, and you determine that the physical structures are worth $10 million, your depreciation allowance for each year will look something like this:

$10M/27.5 years = $363,636

Now that is an attractive deduction!

Savvy investors who are looking for a shorter hold period, somewhere between three and seven years, can take it even further by utilizing cost segregation to identify and accelerate depreciation on short-life property. This acceleration of the depreciation increases the allowance, which in turn increases cash flow and further reduces the tax burden during the projected hold period. Investors generally aim at a hold period of three to seven years and use depreciation to its fullest extent.

So should you invest in a REIT or look at Private Placements? It depends on your situation, but if you want to learn more, get a free copy of my book and audiobook, “Next-Level Income” to learn more.

Tagged: Group 3

Subscribe to The Next-Level Income Show