2020 has had it’s share of uncertainty! During uncertain times, having an Emergency Fund can mean the difference between being able to survive personally and professionally or taking big losses. The first thing I did when I started working was to setup and fund my “Emergency Fund”. So what is an Emergency Fund?

An Emergency Fund (E-fund for short) is money that you save for “unexpected” expenses. I like to have a minimum of 3-6 months of living expenses. Ideally 6-12 months if you are a small business owner or your income is highly variable.

Most Americans (57%) have less than $1000 in their savings accounts! So once you have your E-fund set up, you will be well on your way to being more prepared than most for unexpected expenses. Why would you need an E-fund? It could be a medical expense, car or house repairs, or even paying for your day-to-day expenses after an unexpected job loss. One of my favorite business professors called it his “Nuts to You” fund. What??? Well, it was his politically correct way of saying, “If you ever are in a job that you don’t like you can always just tell your boss, ‘Nuts to you!’” I’m pretty sure most of this would call this “F.U.” money!!

OK, so regardless of what the future holds, let’s plan on setting your “E-fund” up in 3 simple steps:

Step #1: Plan your budget

For a 6-month fund, add up 6 months of:

-

Rent/mortgage

-

Utilities

-

Car payments

-

Food/groceries

-

Extras (or any other recurring expenses)

This total is your target E-fund amount. Knowing your monthly average expenses or burn rate is also very helpful as your work to replace your active income with passive income as I discuss in my book. So let’s say your average monthly expenses are $5,000. Your E-fund amount would be $30,000. If you can save $1,500/mon. it would take you 20 months to get there. Of course, you can also add bonuses or windfalls to get there faster.

Step #2: Open an account

This is easy; you can just use a savings or checking account. I used to use a high-interest money market account with Vanguard. Our local credit union pays 3.0% up to $15,000! (as of September, 2020). You can find other high-yield online savings accounts here. What do I use for our family’s emergency fund? I use a strategy called Infinite Banking to earn 4-5% on my savings. If you’d like to learn more, check out the “Banking” section of our website to learn more about the strategy as well as podcasts and webinars that will provide more information and resources.

Step #3: Automate the process

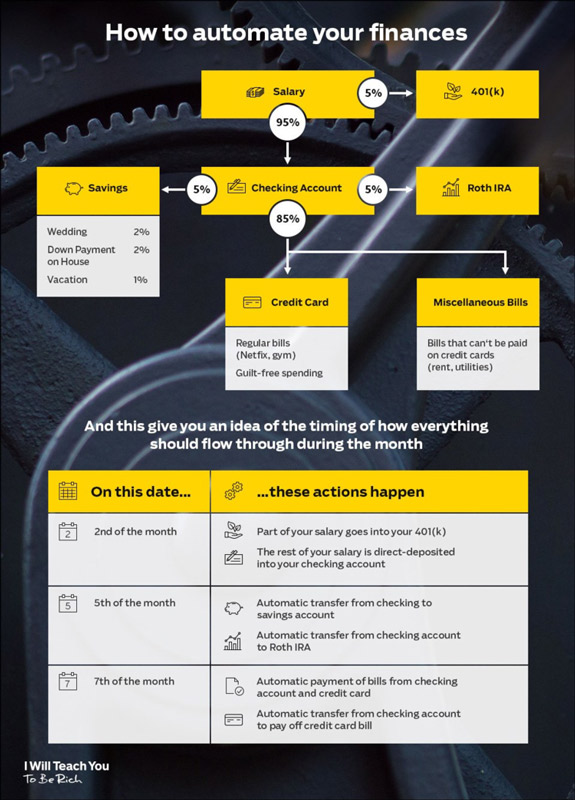

Once you have planned your budget and set up your accounts, you need to make sure that the process is automatic. Every month you should have an auto draft setup so that it happens before you even think about it or have a chance to spend the money.

Let’s take a look of how this looks, courtesy of I Will Teach You To Be Rich:

Once you have this process automated, get to work on the first part of the Next-Level Income Strategy; MAKING more money to increase how fast you get through your first bucket and can start to build your Grow bucket that I discuss in Chapter 3 of my book!

Subscribe to The Next-Level Income Show