Over 8 years ago when I became interested in investing in apartments, we focused on suburban, garden-style apartments in secondary cities in the Southeast (Atlanta, Houston, Charleston, SC, etc.) We felt that the strategy of buying value-add properties in these markets would be a good bet for the next decade. That play has certainly worked out and we have expanded more into the Carolinas and Florida as well.

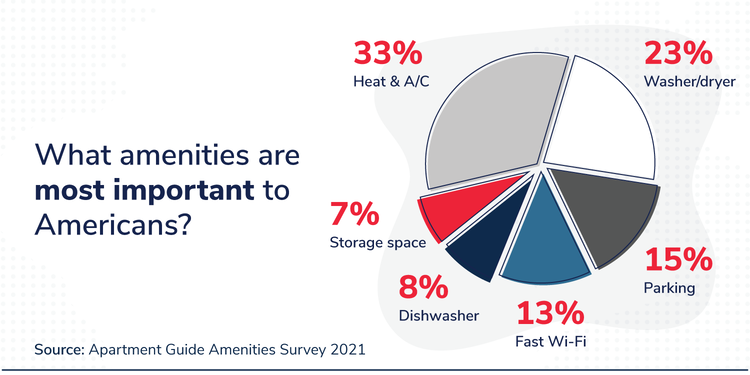

What changes have we seen over the last year? We’ve seen an acceleration of renters moving to the suburbs. They want more space, outdoor areas, and areas to work at home. The amenities renters used to prioritize are now on the back burner, while things like faster Wi-Fi and more storage space have increasingly become more important to tenants. Supplying the amenities renters are in a greater need of gives you an edge in the market and makes your investment property more valuable.

A recent survey by Apartment Guide found that ⅓ of Americans aren’t satisfied with the amenities available to them. While a strong internet connection is a must, the amenities renters value the most are central heating/air conditioning and having an in-unit washer and dryer. In New York, Los Angeles, and Chicago, renters said they pay a $62 premium for in-unit laundry. Likewise, renters were much less likely to shell out that amount of money for a parking spot — most only willing to spend $5 to secure a spot in LA.

This apartment amenity survey also found that nearly 4 in 10 Americans are willing to pay $100 or more for a new living amenity, while men are twice as likely to be willing to spend upwards of $200+ for a given feature. Keeping these key points in mind when deciding to add new features or amenities to your investment property can help you retain tenants and give you a greater return on your dollar.

In my book (get your FREE book and audiobook here), I write about how we employ our value-add strategy in our properties to provide a better experience for residents and that increases both income and the returns to investors. This all begins with knowing the market and what residents want. A $100 rent premium from one of the above amenities across 200 units would increase the value of that property at a 5% cap rate by nearly $5M!

If you’d like to learn more about our strategies and how to invest alongside us, apply to join The Next-Level Investor Club.

Subscribe to The Next-Level Income Show