Subscribe to The Next-Level Income Show

What if you’re totally capable of building your own wealth? Would you take that opportunity? Listen to this episode as Mitch Stephen explains how you can definitely start in real estate with no bank behind you and without having a lot of money. Mitch has been a self-employed real estate investor for decades. He shares strategies on how you can buy houses without a bank. He’s mastered the art of raising private money and the classic “nothing down” deal. He also talks about his upcoming book The Art Of Private Lending which focuses on minimizing your risks. Tune in for more!

—

Watch The Episode Here:

Listen To The Podcast Here:

How To Buy 1000 Houses WITHOUT A Bank With Mitch Stephen

In this show, you don’t want to miss Mitch Stephen, both educational and highly entertaining. Mitch tells you the story of his first deal and how he used the baseball bat to close that deal, how he buys and sells over a hundred, and he’s no recourse on this lounge.

—

In this episode, we have Mitch Stephen. Mitch has been a self-employed real estate investor for many years. His real estate investing career started at the age of 23 when he read Nothing Down by Robert Allen. Mitch Stephen has purchased well over 2,000 houses around his hometown of San Antonio, Texas. He’s a high school graduate, but he never stopped learning. Books, CDs, seminars and webinars were his classroom. Now, after writing four books, on his way to his sixth book, he specializes in owner financing properties to individuals left behind by traditional lending institutions and giving new life to properties that scarred neighborhoods. He’s perfected a method of achieving cashflow without having to be a landlord to rehab properties and he’s mastered the art of raising private money and the classic, nothing down deal. We’re going to talk about that as well as his new book.

-—

Mitch Stephen, welcome to the show.

What’s going on, Chris? It’s a pleasure to be here. Thanks for having me.

I had a blast being on your show. I love your history and all that you’ve done. For our audience that might not catch my interview on your show, maybe catch us up a little bit and talk about your background, history, how you ended up in San Antonio and what you’re focused on now?

“Life is a process. Take one step at a time because every event

will help you figure out how

to go on.

I graduated high school at eighteen. It took me about sixteen years to find what I was supposed to do and where I belonged. I tried everything else in between. Sometimes people ask me, “Mitch, how did you get into real estate?” I said, “It’s the last thing left. If it didn’t work, I was going to shoot myself because I tried everything else. It didn’t work out for me.” I had a high school degree. I had a glass ceiling. No one wanted to pay me what I was worth. In my book, My Life & 1,000 Houses: Failing Forward to Financial Freedom, it’s a story more entertaining than the rest. A lot of my books are how-to’s. This one’s a story about how a dumb ass figured out how to buy 100 houses a year for over two decades.

It was a morphing process. I kept coming to these conclusions a little bit at a time, usually over some great painful event and trying to figure out how do you stop that pain from happening. When something pleasurable would happen like I’d make some money or I’d find a strike, how do I ramp this up? How do I do more of this? Over the years, I’m not the smartest guy in any room ever, but I have been in many years on the same field. I’ve been kicked, shoved and stabbed in every different corner of this business until finally, you figure out where the knives and the guns are and how to protect yourself.

I bought a house every 4 to 5 days for over two decades. That doesn’t count the ones that I didn’t buy, so there’s a lot of experience and the ones that I missed fell through or I didn’t get. There are thousands of houses of experiences in this. After a certain amount of time, you should get good at it. I think I’ve put in my 10,000 hours. I figured it out one day and if I only worked twelve hours a day, I’ve put in 60,000 hours. If 10,000 hours makes you a pro, I don’t know. I got 60,000 hours at least.

Let’s talk about the beginning. You said it took me sixteen years to figure it out. One of the things that I enjoyed talking to you about is Robert Allen because I read a bunch of his books. That’s something we both have in common. Let’s go back to that first deal, Mitch. I’m going to guess you didn’t go from buying zero deals to buying a deal every 4 or 5 days overnight.

I did. I quit my job in March of 1996 and I bought 45 houses that year. The next year, I bought 65 and the next year, about 150. That was too many, so I settled in around 100. What Robert Allen did for me was, it was a very pivotal time in my life. I was getting to be in my early to mid-30s and I still hadn’t found myself. I had read this book by Robert Allen, who had the audacity to suggest that I didn’t have to have any money to make a lot of money in this business.

I started to see how if you don’t have money, then you’re a professional deal finder, contract writer upper. It didn’t take a lot of money to figure out how to write an effective contract, how to go out and call on people and try to negotiate great prices. It was some negotiating, books, and then I had to spend some time with a realtor or attorney who explained these contracts to me because I’m not the most literate person in the world and I’m certainly not good at reading contracts. I had someone explain every paragraph to me and which paragraphs were ultimately important to me and which were the throwaway paragraphs that I didn’t need to pay attention to, but they were in there and this is what they mean. I almost didn’t go into the business because the paperwork was intimidating me too much because I’m not a paperwork guy.

I think there’s a huge lesson in there. The fact of the matter is you don’t have to be good at everything. You be good at what you’re good at and find somebody else to put on your team that can help figure that out.

If you don’t have money, you better have time and expertise because that’s all you have to gain and you got to figure out how to profit without money. Most of the people I know that started in this business, almost 100% didn’t start with any money, and a few that I know that started with a lot of money lost it all and had to start over again with no money. Someone comes to me and says, “I got $1 million and I want to go into the real estate business. Will you train me?” I said, “Yes. Here’s the first thing we can do. Go put the $1 million in a CD somewhere and we’re going to learn how to do this business with no money. If you can learn how to do it with no money, then it’s time to use your money because you’ll understand how it works.”

You read Robert Allen’s Nothing Down. You go out. Let’s talk about that first deal you did, Mitch.

No Bank Real Estate: If you don’t have money, then you’re a professional deal finder, contract writer upper.

I stumbled into it. One thing I learned from Robert Allen is you have to make offers that fit your financial standing, which mine was zero. I had no money, so I had to make offers to people that would work and my first deal was a fourplex. The old man had a lot of rental properties. The son was the typical silver spoon in the mouth son, didn’t know how to do anything, wasn’t driven to do anything. He inherited all these houses because his father passed away. This particular fourplex had a self-designated rent collector who lived there. He was a very ominous, tattooed-up guy that probably wasn’t into good things. He was intimidating the young man and collecting the rent from the other three tenants and keeping it. He had everybody intimidated. I recognized that he was afraid of this problem and was trying to sell it, so he was don’t-wanter.

I told him I could relieve him with that problem and I would handle that guy. I would handle that monster he had over there, but I needed nothing down and I needed no payments for a year. The reason why I needed no payments for a year is because after I got all these people out, I was going to have to completely remodel four units and I was going to take everything I had. I didn’t have anything, but I had lots of credit cards and I have good credit.

At that time, they were offering 0% introductory offers for 12 months, 18 months or 6 months. I had gotten my hands on a bunch of those cards, thinking, “I’m going to need some amount of money at some point. I needed someplace to go to get it. I’m not going to go out in the street and beg for it. I need to know where it’s coming from.” That’s where I went. He agreed to it because I told him, “It’s going to take me a year to turn this place around.” It turns out it only took me 45 days to turn it around, but who would have known?

I knew, but I was selling that it’s going to take a long time to fix this place. The guy was very afraid of this place. He didn’t know how to do anything about the place. He gave me no down and no payments for a year. In 1996, I racked up $30,000 or $35,000 worth of credit card debt fixing up these units. The interesting story is how I got the guy out. I’m not telling anyone to do it like this, but back then, it was more of the Wild West.

Were you in Texas at that time?

Yes, and it’s July. It’s 105 degrees every day. This fourplex was military housing because right across the street was a fence and a military base. You looked out your front door and you saw the fence and then there was the big vast military base. It was built in the ‘20s with hardly any installation or anything and old built. I was going up to talk to this guy and there was a baseball bat in the front yard. I picked it up and turned it around to put the handle towards him so I didn’t look threatening. I said, “You got this bat out in the yard. Is this your kid’s?” He said, “Yes.” I said, “I need to come in and check the air conditioning.”

I didn’t hand the bat to him. I kept holding it by the opposite end, so it wasn’t threatening. I was holding it with one hand down on my side and he let me in. There were all window units. I said, “Your window units are not working right.” He goes, “No, it’s blowing cold,” and it was blowing cold. It was fine. I said, “It’s not up to par. It’s not what you need.” He says, “What’s the matter with it.” I turned the bat around and I started banging on the air conditioner, breaking it. I was trying to knock it out of the window, but it wouldn’t knock out, so I kept hitting it the air conditioners.

He goes, “What are you doing?” Every time he’d step forward, I’d swing the bat back so he’d have to step back, then I’d hit it. He’d stepped forward and I’d swing back and he’d back up. I kept hitting the thing. He said, “What are you doing?” I say, “I’m fixing this air conditioner.” He says, “You’re not fixing anything.” I said, “I fixed it perfectly now. It runs like you pay. I got to go now.”

The only reason I could do this was because I’d already done my research and the man had warrants for his arrest. I knew he couldn’t call the police on me because he had warrants. As I was on the way out the door, I said, “I know you have warrants for your arrest, too. I think you need to be out of here by midnight tonight or my friends that work at the police department will be here about 12:00 and they’re going to pick you up. They will get you out of my house for me, but you will have a nice place to live. They’re going to serve you three meals a day and it will be air-conditioned there.” He left.

Did you have somebody on standby in case that didn’t work out as well as you planned?

I wasn’t that smart. That was a long time ago. I’m not telling anyone to do this. I’m only saying that’s what happened. I got one person out and I worked on the duplex. I got it rented. I had already given the other two people notice to get out. While I was working on those two, I gave them the 30 days notice. By the time I finished, I was working on that one and those two. I got them all rented and the rent coming in would go straight to my credit card bills. It paid my credit card bills.

“If you can learn how to grow in the real estate industry with no money, then it’s time to use

your money because you’ll understand how it works.

By the time the year was up, I had paid all my credit cards off with the rent money that I was collecting. I was collecting about $5,000 a month. It’s a little over $1,000 apiece. The math worked out. I knew this math would work out. That was my plan the whole time. Get a year free, I’ll put the rehab on the credit cards, and I learned all that from Robert Allen. He was like, “How do you make it work? How do you figure it out if you don’t have anything?”

You went on to do 45 deals the first year and scale up to 150. I wanted everyone to hear that first story because I talked to a lot of investors like, “How do I do this first deal?” I say, “You got to look for a deal with hair on it.”

The other thing I want to be transparent about. It was a lot different time back then. There wasn’t a guru on every corner. There wasn’t a course, internet, podcast, and Zoom.

No Bank Real Estate: If you don’t have money, you better have time and expertise because that’s all you have to gain and you have to figure out how to profit without money.

You had to see people on stage, get tapes, and books. I have boxes of them.

They had some of those guys out there, very few. Carleton Sheets was around that time. Dave Del Dotto, Jimmy Napier, and Jack Miller but they were obscure. They were cult-like way back in the background somewhere. When I was doing this, just so you know, 45 houses in my first year. When I started out, you could get in the classifieds at 8:00 in the morning and by noon, you could have a perfectly good deal. If you screwed up, you’d have two and you wouldn’t even know how you’re going to pay for the one, much less two. It was a different time. I want to be clear about that, but it does still show adaptive, out-of-the-box thinking and how to manipulate wherever you’re at. These days, there’s much more sophistication in what you can do and what you can’t do although, prices are higher. I went on beyond that.

I took the credit cards to another level. In 1996, you could buy houses on the lesser parts of town, Eastside, Westside, Southside for $10,000, $12,000, $8,000, $15,000, or $20,000. We had the cheapest houses like Detroit. My neighborhoods were functional rough, but they weren’t blowouts like Detroit. There were still semi-decent neighborhoods or you could still function in these neighborhoods without getting killed. I started buying houses. It’s not the same time, but I figured out that if you have good credit and you apply for a credit card, they send it to you, the full card, the full boat, the full cash advance. They check your credit and send you the card. When I figured that out, I sent out 75 credit cards in a two-week period and I got 45 or 50 of them.

I went around town going, “I need $10,000 on this card and this buys the house and rehabs it.” I took those two credit cards inside the file because when I sold the house, I would get 100% of the money in my bank account because it had no liens on it because it was on the credit cards. I opened up the file and called the credit card company, find out how much I owed both of them. We paid the credit cards and whatever was left over was mine, which most of the time was $15,000, $20,000, $25,000, or $30,000.

I went from not knowing where I belonged to like shooting out of a rocket trying to figure all this stuff out by myself and common sensing my way through. At one point, I had like $250,000 worth of credit card debt and $500,000 where the house was free and clear. That’s when my wife packed her bags when she found the credit card bills. We’d only been married about 30 days. I knew she wasn’t going to say yes, so I did it on my own and tried to make it to the mailbox. With so many credit cards coming in every day, I missed the mailbox one day and I got discovered. She was going to divorce me because she thought I was a lunatic.

The reason I didn’t ask her was it’s taken me seven years and all these books of reading to get where I was at. There’s no way I was going to explain it to her in a 30-day period or anything. It’s taken me years to get this nerve or this confidence, whichever way both. I explained to her. She had her bags packed. I stepped between the car and the door, so she couldn’t shut it when she got in. I said, “If you give me 60 seconds, I’ll explain and then you can do whatever you want to do. You’re being irrational,” which I learned not to say to your wife. She looked at her watch.

She says, “You got 60 seconds.” I said, “This is not gambling by any stretch of the imagination. This house that I bought for $20,000, I know exactly what it’s worth when it’s fixed up. It’s worth $45,000. I’m going to put it into a context that I’m gambling and here we go. You think I’m gambling. Let’s put it in the context of a five-card draw. I’m at a poker table. We’re in a five-card draw game. I got $250,000 on a table and I’m discarded two cards and I’m waiting for my other two cards to come back and you’re leaving before I get my two cards. What if I win? Leave me if I lose. Why are you leaving before the game’s over?” She said, “You better win,” and she went back to the house. I proceeded to win and I’ve been winning for many years after that.

Let’s shift gears a little bit, Mitch. This is the fourth book that you released. Your fourth book is The Art Of Private Lending.

I wrote it with my partner, Mike Powell. In the book, we’re explaining how to minimize your risk and how I’ve been able to survive for many years without having gone under because of the loans that I make and why my private lenders haven’t gone under because they made loans to me under certain conditions. I explained these conditions and the paperwork and why that a person shouldn’t be afraid if the maximum they’re loaning is $65,000 on a home that’s $100,000. To put that in more complicated terms, when you’re only loaning a 65% loan to value, you have a 35% pad there. Everyone should be comfortable. I’m comfortable as the guy who’s buying the house because I got enough margin in case something goes wrong. I don’t get upside down, but my lender, if he happens to not get paid by me, which has never happened.

In the event I didn’t pay him, he would get my house. My promise always was, if I can’t pay you or don’t want to pay you, I will walk my position in that house to you. Be it a note that I have with someone in it, I’ll walk the note over to you and my first-lien collateral rights or I’ll walk the deed over to you depends if I own the house or I have sold the house on seller finance terms that I have a note. If I ever can’t pay you, you won’t have to sue me. I’ll walk these papers over to you. That’s the integrity level. I tell my private lenders that every time, “I have two rights every day. I have the right to pay as agreed or the right to walk my position over to you,” because all the $26 million that I have out is non-recourse collateral only wrappable loans. I’m allowed to wrap.

Let’s talk about this. Our investors are familiar with this. We go and buy apartment buildings and that debt for them is non-recourse. That means the banks are not coming after them. They’re going to take that property back. Mitch, you’re doing this with single-family homes. Share with the audience how you are doing that.

You don’t pull money. If you start pooling money, you get into SEC regulations and all that. Mine doesn’t fall under the regulations because I have one lender, one piece of collateral, and one borrower. It’s a collateral-only loan. If I don’t pay them, they either get the house because I walked it over to them or they file a foreclosure on me, hire an attorney and foreclose me out of the house. They’re going to get my house one way or the other. My promise is if for any reason I don’t pay, I’m going to walk it over to you. You’ll never have to sue me. That’s the agreement. That’s how I sleep at night, owing $26 million.

The only reason I have collateral-only loans and I pay a premium interest rate to these people, 8% on average, 10% to some of them, is they’re sharing in the downside catastrophic risk, which was the only thing that kept me awake at night, not whether I was going to be able to run my business right and make it all work. What petrified me is, what if Kim Jong dumb ass over in Korea drops a nuclear bomb in downtown San Antonio and pollutes a twenty-mile radius of my town. That’s not my fault. I don’t want to lose my storage and house and all my free and clear stuff that has nothing to do with this over something that I had no way of knowing. I’m paying a premium, but you share in the catastrophic risks of this house. If you’re not worried about a meteor hitting this town, a volcano going off or a nuclear bomb being dropped, then you’re in a great position.

How are you finding all these houses, Mitch? How are you finding the money? Are you keeping these houses forever? Are you selling them? How’s the whole process work for that?

The problem was, I used to buy the houses, create the notes and sell the notes. One day in 2001, the associates, which was a division of Ford motor credit who blocked all the secondary notes out there, all the subprime notes. No matter who you sold your note to, they were bundling them all up into millions of dollars where the bundles, if not billion-dollar bundles. They were taking them to associates, selling to the associates, and making 1%, but they were huge numbers. When they closed, the note buying business ceased in the United States of America for all practical purposes for about seven years.

I had 53 houses in my inventory at the time and my whole way of doing business was ruined. My exit strategy was ruined. I was in a panic for that for a few days and then I said, “The only problem is, I’ve been borrowing money for twelve months because I was in and out of these houses. I have to change the color of the money underneath. I need 10-year and 15-year money that I can wrap. That they make a payment to me and I make a payment to my private lender.” It goes on for years. That’s why I have $26 million out because, unlike a flipper, you could put out $300,000 and then in 90 days or whatever it comes back. I put out $300,000 or $1 million on a bunch of houses. They don’t come back for ten years. I had to keep finding more money and it keeps racking up, so I became very good.

One of the reasons I wrote this book was to help explain to people why loaning on real estate is a good deal, how you can move your 401(k)s and your IRAs into a self-directed plan so that you can decide and quit leaving your financial future to the whims of Wall Street and that ticker tape and/or taking the only other choice, which is the leave it in a CD at 1%. I found a happy medium, great collateral, premium interest rate that they’re earning and a track record to boot.

“Loaning on real estate is a good deal.

I’m explaining in there the paperwork and why it all worked and why it’s all worked these many years and that you can go out there and loan your money if you want to directly to people like me, individuals and make 14%,16%, or 18% if you want to go to work. If you’re going to make 14%, 16%, or 18% on your money, you’re going to have to do the work. If you want to make 8%, 9%, or 10% and keep playing golf, then loan it to me, but I’ll use the same strategy, the same protections that I’m telling you to use otherwise. Some people that get my book go on to open their own hard money business or take their own stuff and get their own money out themselves. Other people say, “It sounds like a little more work than I want to do at 68 years old. I think I’ll loan my money to this guy that seems to have it all figured out for many years.”

That’s how you’re finding. About how many houses you buy a year now, Mitch?

It’s always about 100 since. In 2020 and COVID, I did 83, which was a little less than I thought but a lot better than I thought because I thought I was only going to be at 30.

If you’re buying 100 houses a year, are you keeping all these? Are you selling them? How what’s going on?

I’m selling them. Seventy percent of them, I owner-finance my buyer. They make payments to me. I give them a 30-year note at 10%, no balloon. They own me payments for 30 years.

You got both sides of it figured out now.

I buy the house for $50,000. I bought it from a private lender, 8% percent for 15 years. The lender knows I’m going to wrap. He’s given me permission to wrap in the deal. He also knows its non-recourse collateral only. Banks love me. I’m so bankable. It’s not even funny because I have lots of debt, but I don’t have any recourse debt. I take this $50,000 purchase and I sell it for $100,000. I sell it with 10% down and I’ll carry the $90,000 at 10% for 30 years.

I’m paying out on $50,000 at 8% and I’m collecting on $190,000 at 10%. I’m making 2% on my borrowed money. If I have $26 million out, that’s like I have a $26 million, 2% CD and then I’m making the full 10% on the difference between the $50,000 and the $90,000, so there’s $40,000 there. I’m making the full 10%. I got paid $10,000 as a down payment to do this because I have zero of my own money in this. That $50,000 represents the whole house, the repairs and everything. I’m all-in at what I borrowed. I never want to be all-in over 65% of what I can owner-finance the house for. I get those things racked up and to answer your question, no, I don’t have 2,500 notes. People pay me off whether I like it or not. Now, my people are not inclined to go refinance. That’s the problem with putting a balloon in with these people.

The reason they’re buying a house that you had 30 years at 10% interest from seller finance is because they’re flawed. If you think by putting in a balloon payment that they’re somehow going to straighten themselves out, they’re not. They’re going to be flawed in five years, too. They can’t seem to always make the car payment on time or whatever. I learned early on that expecting these people to change and to be able to refi, no matter how you work with them.

You are setting yourself up for failure.

You’re setting yourself up for worse because if a person puts a lot of money down, which should be a good deal in the beginning like, “This guy put down $25,000 on a $75,000 house. Way to go.” In five years when he doesn’t make the balloon, we’re all in court and a judge going, “You’re going to take this man’s $25,000 in five years worth of payments and he put in grass, a fence, a back porch and a pool? No.” By the law, it should be my house. He can’t do what he said, but the court hates you and they’re going to rule against you. I started making straight seller finance notes.

They can pay you off if they want to.

They can pay off with no penalties. It’s against the law to have a penalty on a homestead anytime they want. When you have hundreds of people paying you their mortgage payment, how I usually end up getting the call for a payoff is they need to move. They put the house up for sale with a realtor and the realtor finds a new loan buyer and now I’m getting a call for a payoff, which is a good day, too. I prefer that all my houses go the full 30 years, but they never will and never do. Very seldom. I’ve been in business for many years. I have one person that’s still making that original payment.

These people have a hard time finding a place. They want to own it. They want private ownership. How are you finding these people, Mitch? I know we talked a little bit before. You’ve had to solve a lot of problems in your time. How are you finding these people to buy the houses for you?

How we sold houses was we had a salesperson and we put twenty bandit signs around each house in one sign in the front yard. I’d have fifteen houses for sale on any given weekend. That’s over 300 bandit signs. My one sales guy is getting 150 to 200 phone calls a weekend. Half of them were tire kickers and, “After you explained the whole thing. I’m sorry. I thought this was for rent or will you rent it?” “I don’t have a down payment.” I was like, “Oh my gosh.” By 1:00 on Saturday, my salesman had quit and he’s checked out. He’s had enough.

I had to invent LiveComm.com as in live communication. LiveComm sales phone numbers. They’re $0.02 apiece a month. Every phone number comes with a text distribution list and they’re smartphone numbers that we have nowadays. Smartphone numbers capture the incoming caller’s cellphone number and put it in the text distribution list. No matter what they’re calling that line for, if they’re calling from the cellphone, I’m snagging their phone number. It’s going in a text distribution list, so I can talk to these people later or tell them about the next house I have or tell them that I’ve reduced the down payment on that house or tell him I changed the price or I text them back and say, “I’ve decided to remodel the house. Check me out in two weeks when I’m done. I’m not selling it as is now.” Using that technology, we don’t have to put out any signs. We don’t even put out a sign in the front yard.

How do you get people calling in then?

I had so many people calling during the period that I had signed that I worked myself out of having to have them. In San Antonio, Texas, a population of 2.5 million people, I have 10,000 people that have called my owner finance signs that refuse to get off my list. I’ll send them a text like once every six months saying, “If you no longer want an owner finance house, reply to this message now with the word STOP and I’ll quit sending you this stuff.” I have 10,000 people that won’t leave. I can text them all using LiveComm for $0.02 apiece. What I’ve learned is I only need to text 3,000 to sell my house.

How I learned that was LiveComm has a hello button for every phone number. If you choose to turn on the hello button, then whenever they finish a call, listen to the recording about that house that says everything. By the way, it answers at 6:00 in the morning or 12:00 at night. This recording answers and delivers a perfect set of information. The salesmen never could do that. Never could deliver even one house the perfect amount of data all correct. They call the number. I have the LiveComm number forwarded to a recording within LiveComm. Make the recording. They’re calling, getting all the information, I’m capturing their phone number. When they hang up, if I have this hello button turned on, they’re getting a text right after they hang up that says, “To keep up with my inventory and be notified every time I have a new house come for sale, go to my Facebook page.”

On my Facebook page, I post all the pictures of my houses and how much it takes to buy them. I’m training my people how to buy my houses. If you’re serious, you will give me a $2,000 nonrefundable check that goes towards your down payment. If you’re approved, it is refundable 100%. I’m not moving until I have 2,000. I also need paycheck stubs. I need to confirm with Dodd-Frank. You need to give me this stuff. I’m training them so that when my salesman now goes to show a house. We don’t do this now. We don’t have to, but early on, when he was going to show a house at 6:00, he would send out a text message to 3,000, 4,000 or 5,000 people saying,” I’m going to be at 123 Main Street, where the doors open showing this house if you want to come to look at it.” He’d go to show one person in the house and there’d be ten people in the front yard.

It’s great for sales, too.

He showed the house but now what we did to limit the calls was, we told them everything about the house, but then we didn’t even give them a phone number to contact us then. We said, “If you think this is the house for you and your family, this is what you do. You load up your family in the family car and you drive to 123 Main Street. You get out, walk around the front yard, you walk around the backyard, you look through the windows, you check out the neighborhood. If this is still the house you think for you and your family and you, have $15,000 or more down or whatever the number is, then call the red phone number in the back window.”

Two hundred phone calls that weekend went down to eight and my two sales guys were fighting over them. These people are winners. They vetted themselves, proven they wanted a house, and they can follow directions. They rise to the cream of the crop, but I still have all the phone numbers of all the people that still are interested.

Mitch, your story has been entertaining and educational for all this. For people who want to learn more, how to get your books, if they can work with you, LiveComm, all these tools you talked about, what’s the best way for people to get in touch with you?

Go to 1000Houses.com. Over there, I did my 500-show interview. You can see my show. I finished nine months of a ten-minute segment every working day. I have 180 segments over there, ten minutes long, if you’re interested in the business. If you want coaching or training, it’s all over there. If you want to find my books, they’re all over there. I’m about to come up with my 5th and 6th book. If you’re remotely at all interested in how I quit smoking, drinking and lost 50 pounds and picked up an extra 40 hours a week that I was spending, wasting my time, and how I made that personal transformation without a doctor, a therapist, and a patch.

“These days there’s much more sop

sophistication in what you can do and what you can’t do.

I quit smoking and drinking on the same day a few years ago. I’m not pushing it on anybody. I’m not preaching it, but so many people wanted to know about it and how to do it. I’m giving away a free copy of that book. It’s like 80 pages. I explained my thoughts process and what I went through to do it. It’s 1000Houses.com/enough. I’ve had enough of my addictions and stuff. If you want that free, I’m not selling that. I’m doing that to try to help mankind. If it helps anybody, I’m happy.

Mitch, that’s awesome. It is amazing. In my coaching clients, there are so many people that are high performers who still struggle with a lot of these things. I know a lot of them personally. It means a lot that you’re offering that to our audience. Again, that’s 1000Houses.com/enough. Mitch, I appreciate all the time you spent with us, sharing your story with the audience and providing all the value you have.

Thank you so much, Chris. It’s always a pleasure to be around you. That’s one of the reasons I like doing a show and being on people’s shows because I get to meet and to talk to some pretty damn sharp people, and you’re one of them. I appreciate you very much.

Thank you. The feelings are mutual.

-—

I hope you found this episode valuable. I have one more thing to gift you. We have a page for my coaching clients, where you can get a free copy of my book as well as much more from previous guests on the show. Check out NextLevelIncome.com/coaching to get a free copy of my book, audiobook and much more. I’ll send you a copy of my book and cover all the shipping costs as a thank you for reading. Also, please like, share and take 90 seconds to give us a rating on Apple Podcasts.

Important Links:

-

Interview – Chris Larsen in 1000Houses.com podcast

-

My Life & 1,000 Houses: Failing Forward to Financial Freedom

-

Facebook – 1000Houses page

-

Apple Podcast – The Next-Level Income Show

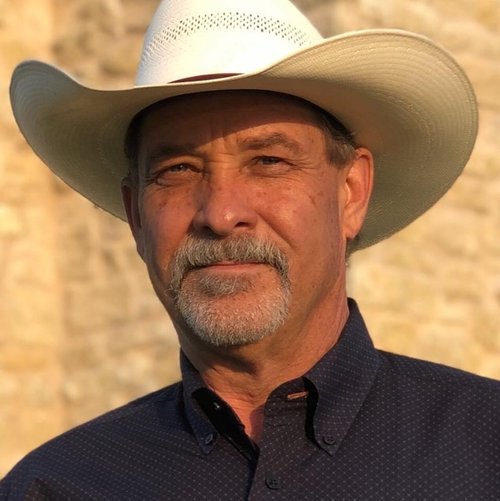

About Mitch Stephen

Mitch Stephen has been a self-employed RE investor for 25+ years. His real estate investing career started at the age of 23 when he read “Nothing Down” by Robert Allen.

Mitch Stephen has purchased well over 2,000 houses in and around his hometown of San Antonio, TX. A high school graduate, who never stopped learning. Books, CDs, seminars and webinars were his classroom.

Today he specializes in owner financing properties to individuals left behind by traditional lending institutions and giving new life to properties that scar the neighborhoods.

He has perfected a method of achieving cash-flow without having to be a landlord and without having to rehab properties. He’s mastered the art of raising private money and the classic “Nothing Down” deal.

He has pioneered the idea that you don’t have to give discounts to sell your notes.

A passionate speaker who delivers the message of integrity first and profits second; an expert at keeping it simple and explaining, in plain English, the theories that made him financially independent. He is always an inspiration to those around him.

Mitch has been interviewing for his podcast for over 3 years and has more than 400 great guests.

Love the show? Subscribe, rate, review, and share!

Join the Next- Level Income Show Community today:

Tagged: financial independence, interest, loans, real estate industry, expertise, good deals, Group 3

Subscribe to The Next-Level Income Show