Finding Investment Opportunities Through Demographic Trends

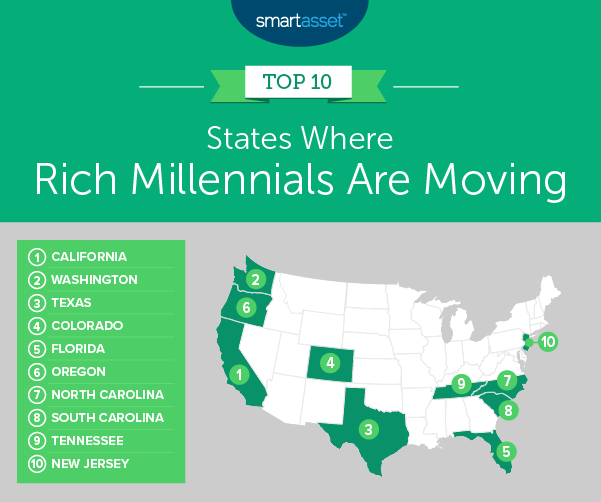

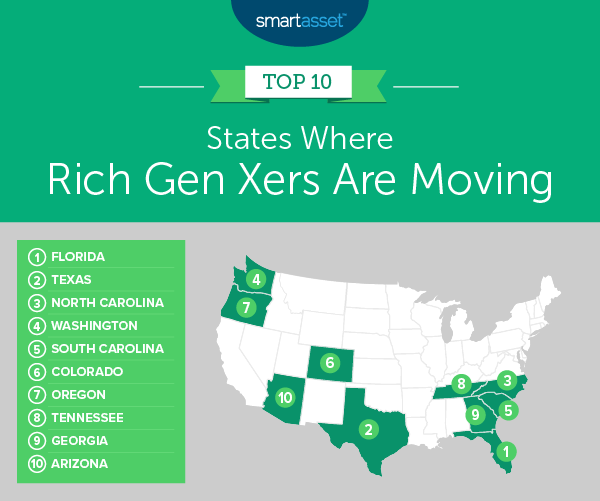

The website SmartAsset recently published two separate articles discussing where Rich Millenials and Rich Gen Xers are moving. (You can find the articles here.) They defined rich as, “adjusted gross incomes (AGI) of at least $100,000.”

As many of you know, I’m a big fan of demographics to determine where future opportunities can be found in investments, specifically real estate, which is my main area of expertise.

A few things that are highlighted in the articles:

-

Millennials are moving to the Coasts.

-

Gen Xers are moving to the South.

-

The Northeast isn’t popular with EITHER group.

What do I take from this data and what are my conclusions?

-

First, I overlay both sets of data and see that the states that are popular with both groups are: Florida, Texas, North & South Carolina, Washington, Colorado, Oregon and Tennessee (Georgia’s 11th on the Millennial list so I would include it on my list).

-

As a demographic ages they prefer lower taxes and lower cost of living states that afford a better quality of life. Make no mistake, Trump’s tax cuts and penalties on SALT are not helping the Northeast and high state-income tax states like California, Illinois, New York and New Jersey.

How can you capitalize on these trends?

If you are young, I encourage you to consider looking to move to a state that has an influx of population and positive demographics. I chose to move my family to North Carolina in 2008 for this reason. There will be more job opportunities and if you buy real estate you will have a larger pool of buyers when you ultimately want to sell. More demand for a limited product typically means higher prices.

If you are older and looking to retire, consider looking at states that are fiscally sound and have growing population bases. This should be favorable for future tax rates and state-level initiatives like infrastructure, etc.

If you are an investor in real estate, specifically multifamily, look at states with a positive influx of residents. I’m still a big fan of the South and have personally invested in Texas, North Carolina, South Carolina and Georgia.

If you’ve read my book, Next-Level Income, then you are aware that while the largest group of renters is under 35, both age groups 35-55 and 55+ are growing even faster with Baby Boomers growing at the fastest rate. If you’d like to learn more about how demographics fuels multifamily investments, you can get a free copy of my book and learn how to get access to cash flow investments.

Subscribe to The Next-Level Income Show