As I finished updating my book, Next-Level Income, the stock market was at an all-time high, as well as its valuation compared to GDP and earnings. 2009-2019 was a great decade to invest in the stock market. So why did I focus so heavily on adding income-producing real estate to my portfolio during the same time?

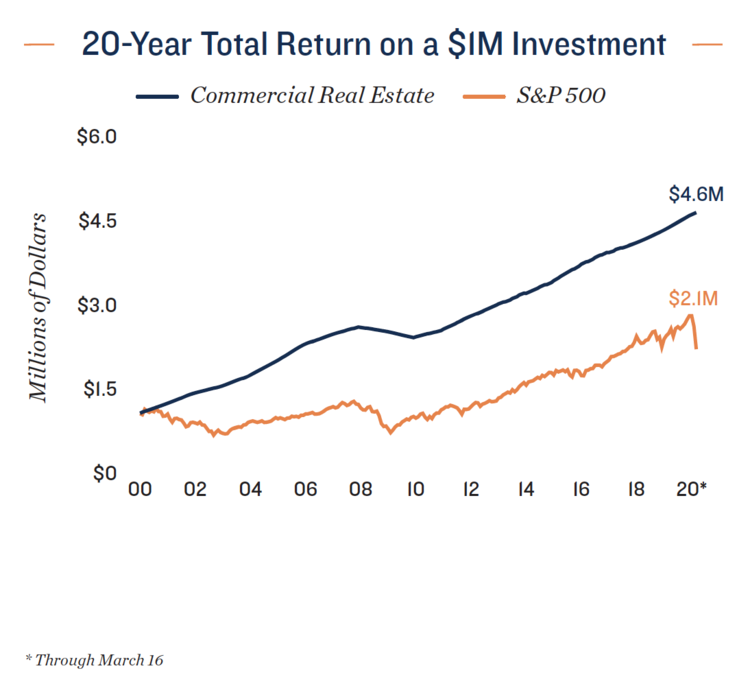

While the stock market delivered exceptional returns in 2019, the recent correction has demonstrated the volatility and risk that goes along with those returns. If we compare this to real estate investments, they only averaged 7% last year. However, comparing the two asset classes over the long term demonstrates the advantages of real estate. If you invested in commercial real estate in 2000 the average return over 20 years was more than 359% vs. 115% in the stock market.

Source: Marcus & Millichap Special Report – Market Update: Coronavirus Impact on Real Estate.

In fact, direct ownership of commercial real estate, had the best risk-adjusted returns compared to stocks, bonds, and REITs:

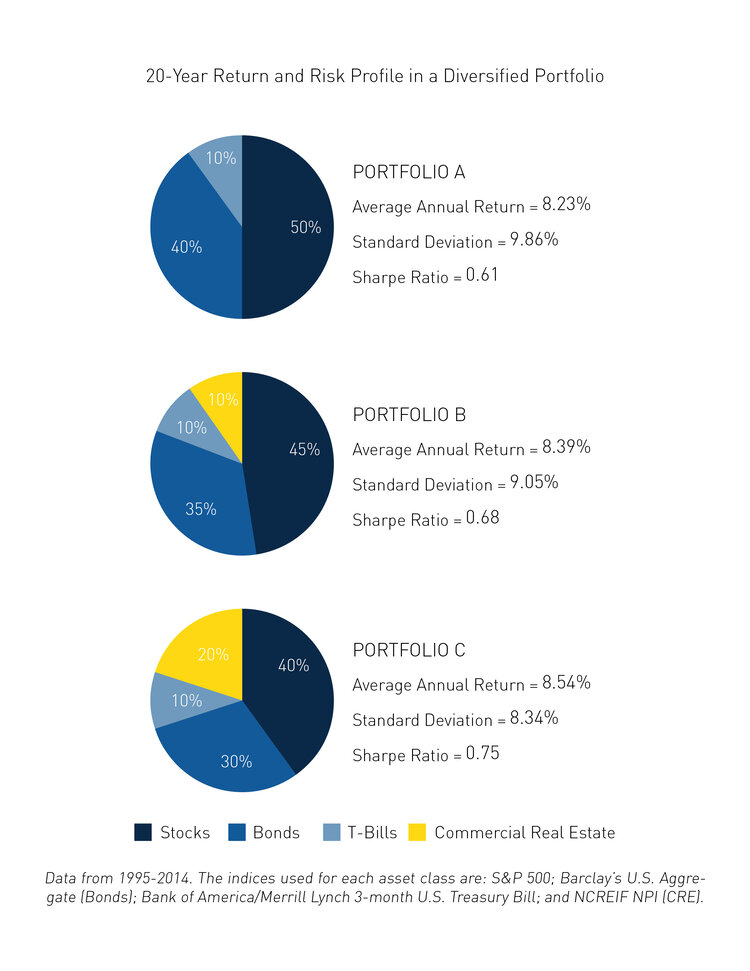

Let’s look at the effect of adding real estate to a portfolio of stocks and bonds.

By investing 20% of the portfolio in real estate, while reducing exposure to stocks and bonds, this portfolio could have achieved a higher “Sharpe Ratio” (risk-adjusted return). This reflects a 23% increase in return vs. risk! Ray Dalio calls this increase in return and decrease in risk the “Holy Grail” of investing. As a direct owner of commercial real estate you can increase the return and decrease the risk of your portfolio.

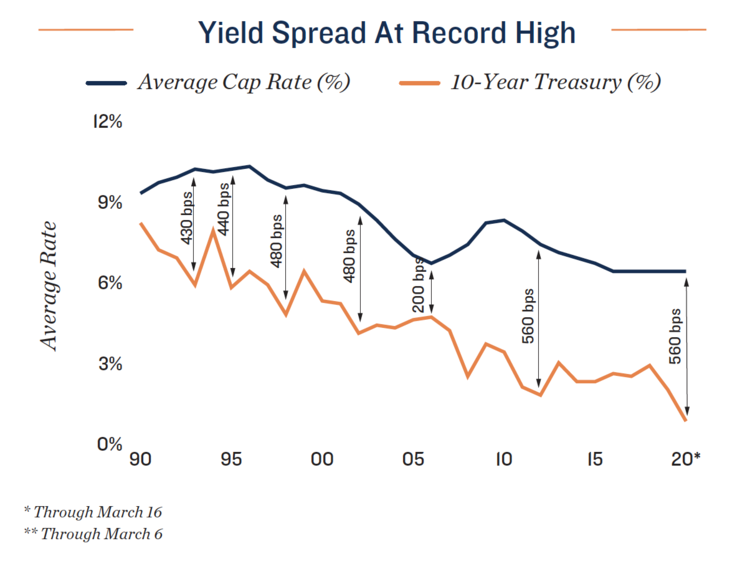

With the falling stock market, we have also seen falling interest rates which make it a great time to lock in exceptionally low rates on loans. Lower rates mean increased yields. While some investors wait on the sidelines, others are maximizing their returns by locking in a lower cost of capital.

Source: Marcus & Millichap Special Report – Market Update: Coronavirus Impact on Real Estate.

Do you want to learn more about why I invest in multifamily real estate and how you can gain access to income-producing investments? Go to www.nextlevelicome.com to get a free copy of my book and request a time to speak to me.

Subscribe to The Next-Level Income Show