In my book (get your free copy here) I write about how we have shied away from vacation rentals for multiple reasons. The hassles, the costs, and ultimately the lack of profits.

Frankly, I don’t even like single-family rentals anymore due to the same issues; however, something has changed since I wrote my book 3 years ago. With the introduction of AirBnB and the explosion of short-term rentals, there is an arbitrage opportunity in the vacation rental space.

Why I Don’t Love Single-Family Rentals

For 15 years I managed my own portfolio of single-family properties. Mostly condos and townhouses, they were newer properties and didn’t need a lot of maintenance. However I had local management teams in place to help me with renting, turning the units and keeping up with repairs. My strategy was to “Buy and Hold” these properties and pay them off by the time I was 40 years old. Since I started at age 21 this was a pretty conservative path. However after 10 years I realized that the tenants, toilets and taxes were not only wearing on me, but the taxes were taking 30% of my profit at the end of the year! My 30+% profits on my initial investment had now shrunk to around a 4% return on my equity. In my book I talk about how I sold ALL of my properties and converted the equity into ownership in commercial properties (mostly multifamily). This allowed me to scale my portfolio to ownership in over 1500 units, provided better returns and was 100% passive. If you are getting started today you may be thinking, “That’s great, but I don’t have $100,000 to invest in an apartment syndication. What should I do to get started?”

Vacation Rentals Are Challenging

Vacation rentals can have all the challenges of single-family rentals with even more wear and tear and higher expenses! As I mentioned in my book, we never wanted to deal with these issues and avoided vacation rentals. When you add up all of the costs of a property; vacancies, repairs, normal maintenance, taxes and then add up to 40% management fees your total costs can exceed 75%! There’s not a lot left for profit at those expense ratios. Compare that to an apartment building where our expenses can be as low as 40%. However a lot of people like vacation rentals because it gives them a chance to own a second home, planned retirement home, or just a family vacation property while subsidizing the cost. I have one friend who bought 5 luxury properties around the country and paid them off. He uses them as rentals and his family gets to use them whenever they choose. Of course, not everyone has several million dollars for a strategy like this . . .

Why We Started An AirBnB

AirBnB offers a platform to help you manage and rent your properties. It allows you to find people to rent your property, pay for it as well as verifying profiles and allowing you to securely communicate. When we built our new home in Asheville, NC we incorporated a short-term rental into the plan. We’ve been managing this for over 3 months now with AirBnB and I can tell you that I’ve been pleasantly surprised! Here are some of the differences that I’ve found versus being a landlord for long-term rentals:

Pricing/Earnings

Acquiring Homes

Finding Tenants

Protection

Set-Up

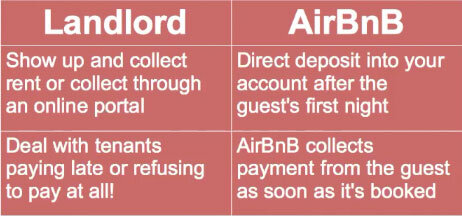

Rent Collection

House Upkeep

Management

Subscribe to The Next-Level Income Show