“A rising tide lifts all boats.” – John F. Kennedy

A recent study commissioned by the National Multifamily Housing Council (NMHC) and the National Apartment Association (NAA) noted 3 things:

-

Close to 40 million Americans currently live in apartments.

-

Over the past 5 years an average of 1 MILLION new renter households formed every year

-

We will need an average of at least 328,000 new apartment homes every year to meet demand, however we are only building (on average) 244,000

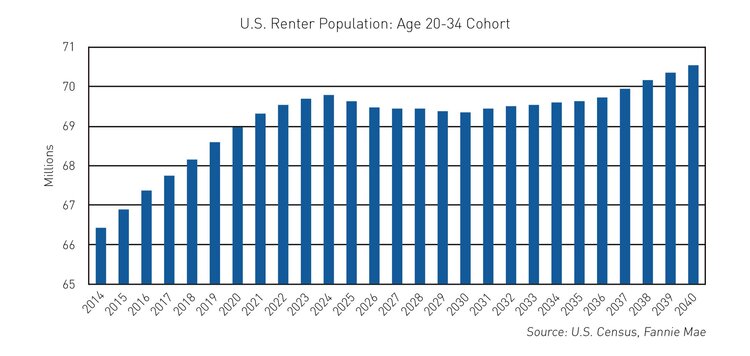

Take a look at this chart that demonstrates the “rising tide” of renters from Fannie Mae:

This rise is going to continue for nearly 3 decades. (Note that this doesn’t include the Baby Boomers who have seen the largest net gain of renters, up 21%!)

What is driving this demand?

-

In the U.S. more and more people are delaying home purchases due to student debt, cost of housing, and life events.

-

Older renters are driving demand as 30% of renters are aged 55+

-

Immigration: research shows that immigrants have a higher propensity to rent and for longer periods

-

BONUS: now even HIGH-INCOME households are choosing to rent!

Charlotte, alone, needs more than 70,000 new apartments. However building new apartments does not solve this problem entirely. The reason? The cost to build new apartments costs around $175,000 per unit! Developers and owners can’t afford to rent these new units for affordable rates. In addition to the need of 4.6 million new apartments, as many as 11.7 million older existing apartments could need renovation this decade. That’s why buying value-add multifamily properties can be a strong play. You can find the study at weareapartments.org and dive deeper into the data.

If you’d like to learn how I used the Next-Level Income strategy to build a portfolio of passive income investments, get a free copy of my book and learn how to get access to cash flow investments.

Subscribe to The Next-Level Income Show