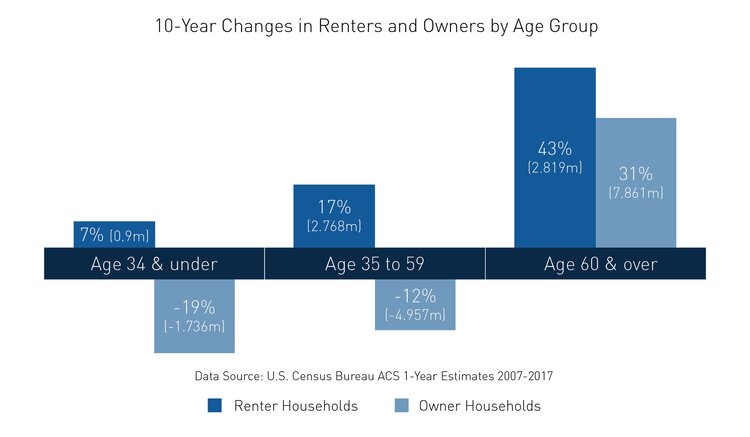

In my new, updated book, “Next-Level Income,” (go to our website to get your FREE copy) I write about the trends that drive different areas of the real estate market and cycles. What’s interesting is that historically the under 35 demographic has typically been the biggest driver of the rental (apartments or multifamily) market. This time around? It’s 35-59 year-olds and going forward will be the 60+ or Seniors. What does this mean for the multifamily market?

First, Millennials are still a large segment of renters, along with immigrants, and as the economy slows during the next downturn they are likely to continue renting. They will extend their rental cycle even as they have already bought at lower rates than the previous two generations. When loans are harder to get and housing markets pull back this will only exacerbate this trend.

But look at the above trends! Baby Boomers crave the freedom and lifestyle that renting affords as they downsize and become empty nesters. Also, they have not saved enough for retirement and are dipping into the equity in their homes to close the gap.

What does this mean to you as an investor? The multifamily market will continue to be strong with multiple demographics supporting the sector. Also, those types of communities that cater to seniors will most likely outperform. This will be more likely in markets that are appealing to retirees; the Southeast for instance, as well as places such as Arizona, Nevada, and Texas.

Keep a very close eye on this trend and areas of opportunity to include as investments in your portfolio. If you’d like to learn how I used the Next-Level Income strategy to build a portfolio of passive income investments, get a free copy of my book and learn how to get access to cash flow investments.

Subscribe to The Next-Level Income Show